State of VC 2.0

View from Seed

SEPTEMBER 14, 2021

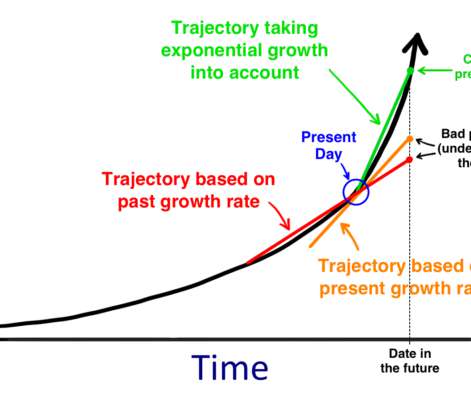

So, four years later, DPI is still trying to catch up with TVPI from 2017. One thing that jumps out quickly is that TVPI between 2004-2010 (avg 2.6x) has underperformed 2011-2017 (avg 3.0x). The chart below illustrates this, with the black vertical line representing the average VC return. The answer is likely a mix of both.

Let's personalize your content