How is the VC Asset Class Doing?

View from Seed

DECEMBER 4, 2019

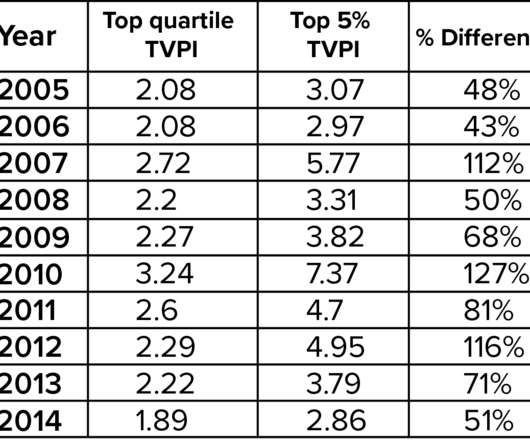

At the time, I spent most of my time describing the metrics themselves and how VCs and their LPs evaluate performance based on these measurements. If you aren’t familiar with these metrics, I recommend reading the original post to get a sense of the numbers that I’ll be reviewing here. So, is this good or bad? That’s only 0.5X

Let's personalize your content