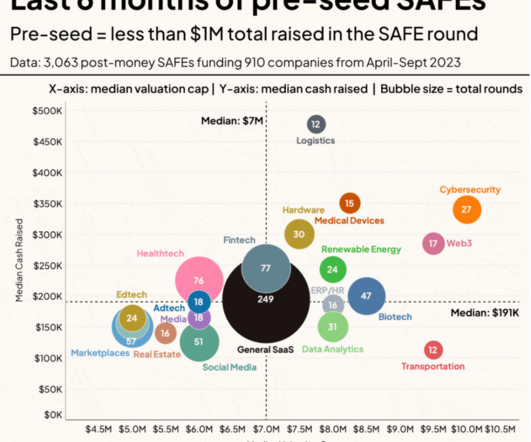

How the pre-seed round made a comeback in 2024

VC Cafe

FEBRUARY 27, 2024

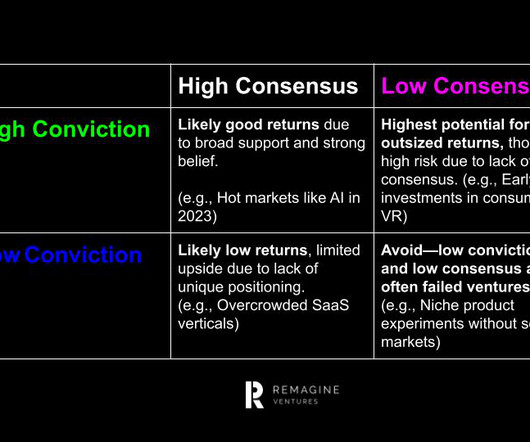

Everyone moved to earlier stage – part of the decline in late stage investing is the ‘baggage’ of companies that previously raised money at inflated valuations that they would struggle to justify in today’s market. That’s yet another reason for micro funds to move earlier in the fundraising timeline.

Let's personalize your content