Segment vs Mparticle

ConversionXL

JANUARY 28, 2021

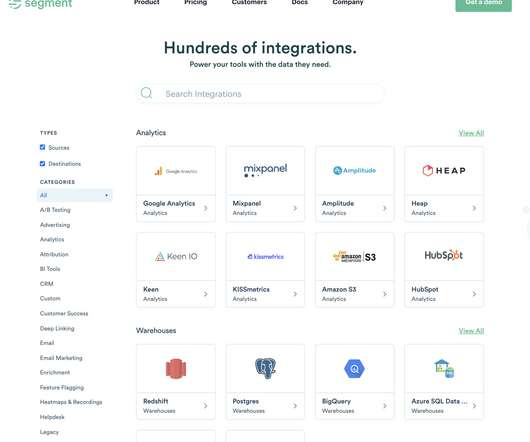

David Raab Founder at CDP Institute. Additionally, on average, businesses receive data and metrics from 28 unique sources. While suitable for web applications and mobile use cases, the general consensus based on digesting hundreds of reviews is that they are strongest for web applications. G2 Reviewer. Avoid Data Silos.

Let's personalize your content