Why Uber is The Revenge of the Founders

Steve Blank

OCTOBER 24, 2017

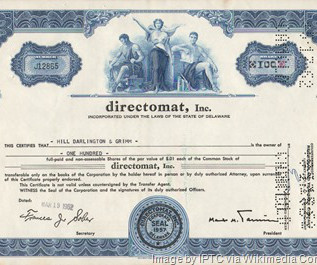

This required a repeatable and scalable sales process, which required a professional sales staff and a product stable enough that customers wouldn’t return it. In the last decade, as the time startups have spent staying private has grown longer, secondary markets – where people can buy and sell pre-IPO stock — have emerged.

Let's personalize your content