8 Priorities When Offering A New Product Or Service

Startup Professionals Musings

MAY 26, 2023

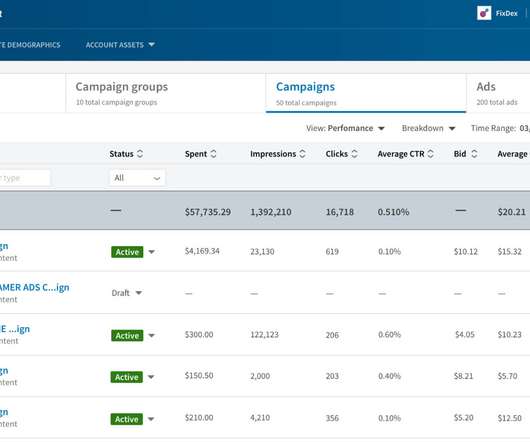

Even though many of these can be mitigated by testing and early customer feedback , you will find that it pays big dividends to do your homework before building and rolling out every new initiative: In today’s customer data overload, marketing is essential. Customers won’t buy what they can’t find or don’t understand.

Let's personalize your content