Why Startups Should Raise Money at the Top End of Normal

Both Sides of the Table

JUNE 5, 2011

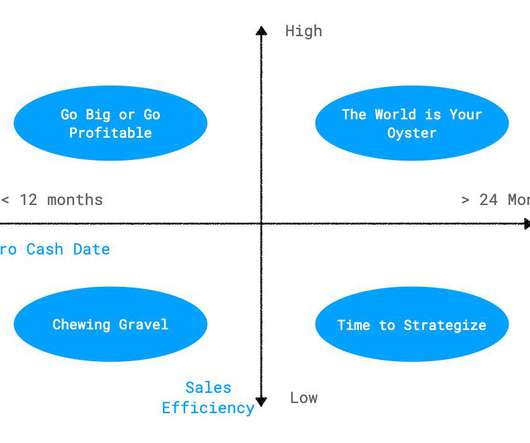

Another firm we saw tried to raise $15 million at a $60 million pre-money with similar metrics. They did an inside round, spent a bunch of money and then went through a fire sale of the business less than 2 years later. But he sold within 3 years for not a huge price after having raised more than $20 million. Here’s the problem.

Let's personalize your content