Launching a Portfolio Acceleration Platform at a Venture Capital or Private Equity Fund

David Teten

APRIL 1, 2021

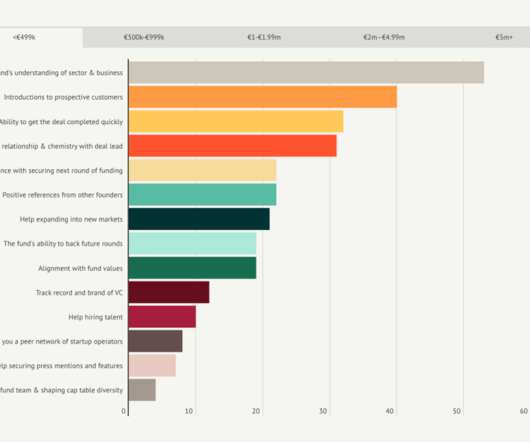

Almost every private equity and venture capital investor now advertises that they have a platform to support their portfolio companies. Relationships with Venture Partners, Entrepreneurs in Residence , and other non-salaried personnel who can help your companies. Extends network dramatically. Customer Development.

Let's personalize your content