Use agile budgeting to manage your cash

David Teten

NOVEMBER 26, 2019

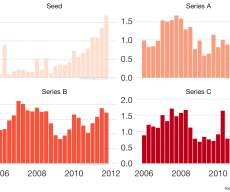

Instead of budget approvals, monitor key metrics and give managers more flexibility. How should a growth company manage their budget? I encourage entrepreneurs to correct course with a re-forecast early and often. The organization replaced the budget with a quarterly forecasting and planning process.…

Let's personalize your content