Spectacles and $SNAP’s $20B Valuation

Austin Startup

APRIL 25, 2017

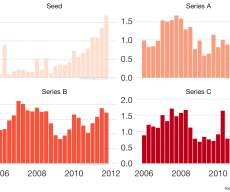

In order to achieve 20x growth, Snap needs grow both of those metrics 4–5x. In summary: Snap’s current business doesn’t justify a $20B valuation. How can one justify a $20B valuation for Snap? The product that could most likely justify Snap’s $20B valuation is Spectacles. Let’s look at each figure.

Let's personalize your content