Praying to the God of Valuation

Both Sides of the Table

DECEMBER 11, 2022

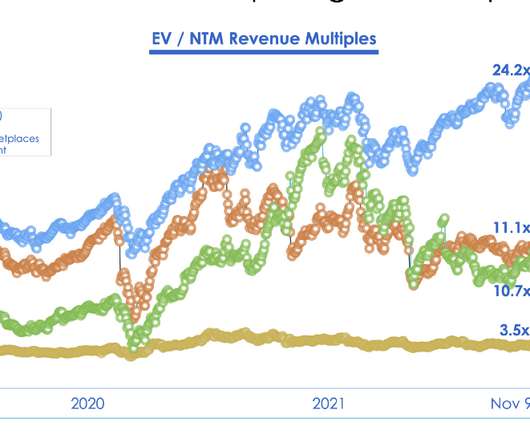

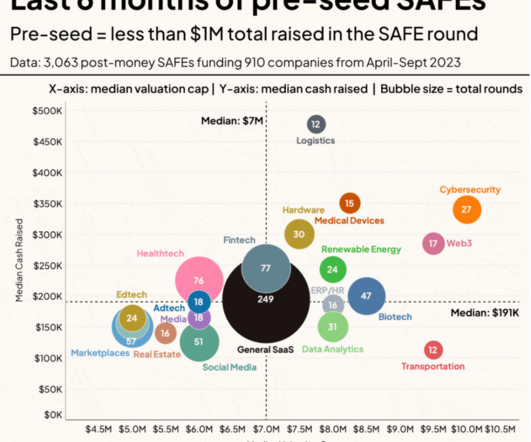

Something happened in the past 7 years in the startup and venture capital world that I hadn’t experienced since the late 90’s — we all began praying to the God of Valuation. And then in the late 90’s money crept in, swept in to town by public markets, instant wealth and an absurd sky-rocketing of valuations based on no reasonable metrics.

Let's personalize your content